THE recent settlement involving 1Malaysia Development Bhd (1MDB) by AMMB Holdings Bhd (AmBank) raises a number of important questions that the scant announcement by the Finance Ministry fails to answer, reflecting the culture of near-complete opaqueness pervading the government over the past year.

The first paragraph goes like this: “The Finance Ministry wishes to announce that AMMB Holdings Bhd has agreed to a RM2.83 billion global settlement on all outstanding claims and actions in relation to the AmBank Group’s involvement in the 1MDB matter.”

But what specifically was this for? There is no explanation. The announcement quotes Datuk Seri Tengku Zafrul Tengku Abdul Aziz, the finance minister, thus: “This latest settlement is beneficial for the Malaysian people. Resolving this through the court system would have cost a lot of time, money and resources.

“With this settlement, the payment of the monies will be expedited instead of being held up by lengthy court battles, and can be utilised to fulfil 1MDB’s outstanding obligations.”

Great – but what are AmBank’s crimes exactly? Who was responsible? Why no criminal action against individuals? And how was the amount decided? How does it compare with that infamous settlement with Goldman Sachs? How much were external lawyers and consultants paid?

The announcement merely says: “This follows the government’s successful negotiations on the Goldman Sachs’ RM15.8 billion (US$3.9 billion) settlement in July 2020. These settlements will not absolve other entities and individuals of their alleged wrongful involvement in 1MDB, and they will continue to be pursued through the criminal justice system.”

But that Goldman Sachs settlement was in two parts – US$2.5 billion in cash and US$1.4 billion in a guarantee to cover shortfalls in recoveries expected by the US government and other agencies.

There was a high chance of recovery. Reports said Goldman Sachs’ own estimate was an over 90% chance of recovering the US$1.4 billion. Effectively, the settlement was US$2.5 billion, not US$3.9 billion, as I pointed out here and explained how it was a lousy deal for Malaysia.

The first thing to note about the AmBank deal is that there is no such guarantee agreement as the Goldman Sachs deal – which indicates already that AmBank got a lousier deal. My analysis shows that in other respects, too, it was bad.

But before that, we need to establish AmBank’s crime. This is outlined in this sources report, the essence of which is that it was related to a RM5 billion bond issue AmBank arranged for 1MDB.

According to the report: “The 30-year government-guaranteed bonds, which pay an interest rate of 5.75%, were 1MDB’s first debt and almost all were stolen by Low Taek Jho (better known as Jho Low) and collaborators, including via a purported joint venture with PetroSaudi International Ltd and a quick flip of the bonds.”

AmBank issued the bond at a steep discount to Low and two others – Vincent Cheah Chee Kong and Shaik Aqmal Shaik Allaudin were said to have profited from it as well.

The duo also started news portal The Malaysian Insider in 2007 before Jho Low took over funding from 2010 to 2014, the report said (In June 2014, the Malaysian Insider was taken over by The Edge Media Group, owned by businessman Datuk Tong Kooi Ong. It was shut down in March 2016).

The modus operandi was to issue bonds below the market price to select people, who then flipped the bonds on the market for a huge gain. It was reported that Low made some RM600 million this way.

I had written about the bond underpricing scam way back in March 2013, but this only came into light in 2019 after the Pakatan Harapan government took over in May 2018 and begun investigations.

The current settlement with AmBank was apparently based on five times the profits of RM600 million that flipping the bonds made for the perpetrators, but initially negotiators, for RM5 billion, claimed the full bond amount of RM5 billion, most of which was stolen from 1MDB.

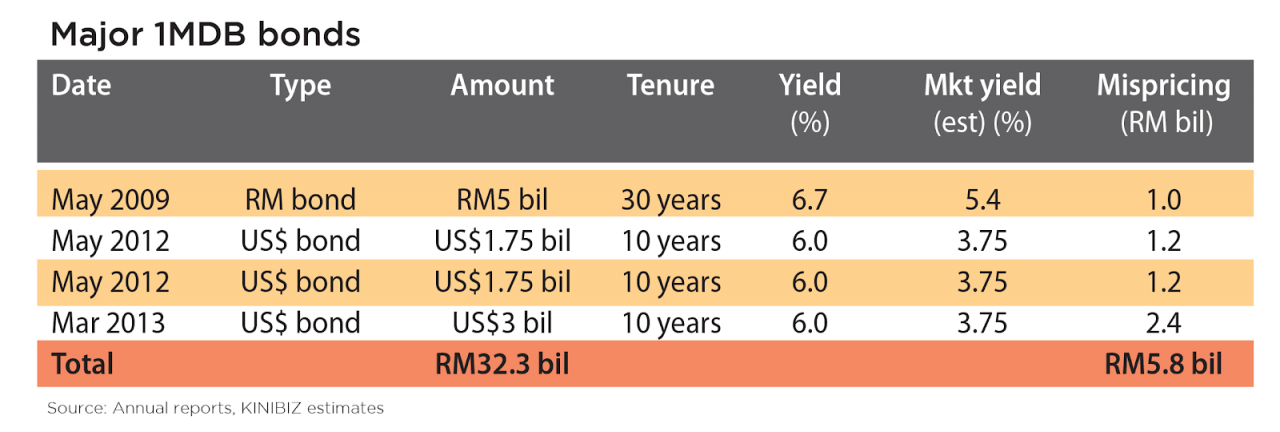

Now, the comparison with Goldman Sachs. I had written about mispricing of bonds, including those of Goldman Sach’s three bonds totalling US$6.5 billion, in this article in 2015. However, it does not seem to be taken into account in the Goldman Sachs negotiations.

The table shows the estimated mispricing of bonds using bond calculators, indicating quite clearly that there was substantial bond mispricing in the Goldman Sachs bonds, too – totalling RM4.8 billion – but these were not taken into account.

In total, the cash settlement for Goldman Sachs was US$2.5 billion (we established earlier that for the US$1.4 billion guarantee, Goldman Sachs pays little or nothing) for US$6.5 billion in bonds, or 38% of the bond amount.

AmBank, whose culpability appears less when we compare the two scenarios (Goldman Sachs played a role in disbursing the funds to fraudulent parties), paid RM2.83 billion, involving RM5 billion in bonds or 57% of the bond amount.

This proportion is 50% higher for AmBank, a much more severe penalty compared to Goldman Sachs’, whose pockets are far deeper than AmBank. Furthermore, 17 senior Goldman Sachs officials faced criminal charges in Malaysia over 1MDB.

Why such a bad deal with Goldman Sachs? This is especially so since it was announced by previous finance minister Lim Guan Eng that the government was seeking US$7.5 billion in settlement, three times the effective settlement of US$2.5 billion cash.

Talk on the streets is that it is not just the government that is involved in negotiations, but also private sector lawyers and others who are paid fat fees. The government needs to disclose what their fees are for both the AmBank and Goldman Sachs deals to put to rest undue speculation here.

If the government wants to inspire confidence that everything is being done above board as far as 1MDB is concerned, it has to raise its transparency levels and be prepared to disclose much more in terms of the bases upon which multibillion deals are made for the recovery of 1MDB money.

Otherwise, there will be lingering, unhealthy doubts. – The Vibes, March 4, 2021

P. Gunasegaram is author of the first book on 1Malaysia Development Bhd titled 1MDB: The Scandal that Brought Down a Government